3.3 — Welfare Economics

ECON 306 • Microeconomic Analysis • Fall 2022

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/microF22

microF22.classes.ryansafner.com

A Reminder (and a Reprieve for a Week or Two)

When and Why Markets are Great

The Origins of Exchange I

Why do we trade?

Resources are in the wrong place!

People have better uses of resources than they are currently being used!

The Origins of Exchange II

Why are resources in the wrong place?

We have the same stuff but different preferences

The Origins of Exchange III

Why are resources in the wrong place?

We have different stuff and different preferences

Transaction Costs and Exchange I

- But Transaction costs!

- Search costs: cost of finding trading partners

- Bargaining costs: cost of reaching an agreement

- Enforcement costs: trust between parties, cost of upholding agreement, dealing with unforeseen contingencies, punishing defection, using police and courts

Transaction Costs and Exchange II

With high transaction costs, resources cannot be traded

Resources cannot be switched to higher-valued uses

If others value goods higher than their current owners, resources are inefficiently allocated!

Transaction Costs and Exchange III

Markets are institutions that facilitate voluntary exchange between strangers and reduce transaction costs

There's a lot of institutions in the “bundle” we call “markets”:

- Prices, profits & losses, property rights, rule of law, contract enforcement, dispute resolution, protection, trust

Transaction Costs and Exchange III

All of those things are assumed/ignored when we “draw” markets as neat graphs on the blackboard

Other courses: how do various political & social institutions enable markets to flourish? (some of my courses):

What Does “Efficiency” Mean?

Regular sense of the word:

Achieving a specified goal with as few resources as possible

Examples:

- carrying groceries

- driving

- producing pencils

Problem: What Goal for Society?

We will ruminate more in coming lessons

Society, government, law, etc. has no single, universally agreed-upon goal

“Society” is not a choosing agent — people have their own separate interests, constraints, etc.

- Economy ≠ a constrained optimization problem!

Social Problems that Markets Solve Well

Problem 1: Resources have multiple rival uses

Problem 2: Different people have different subjective valuations for uses of resources

It is inefficient (immoral?) to use a resource in a way that prevents someone else who values it more from using it!

Social Problems that Markets Solve Well

Solution: Prices in a functioning market accurately measure opportunity cost of using resources in a particular way

The price of a resource is the amount someone else is willing to pay to acquire it from its current use/owner

Social Problems that Markets Solve Well

Property rights provide a pattern of ownership

Prices give us information about how to use scarce resources

Profits incentivize production that creates value and Losses discipline waste

Markets & Efficiency

Economic Efficiency: First Pass

Economic efficiency: degree to which as many people as possible get as much as possible of what they want

- degree of preference satisfaction

- How do we measure this?

- Expanding budget set ⟹ satisfying more goals

- Income is a main constraint ⟹ maximize incomes

- GDP per capita: market value of what is produced ⟺ incomes

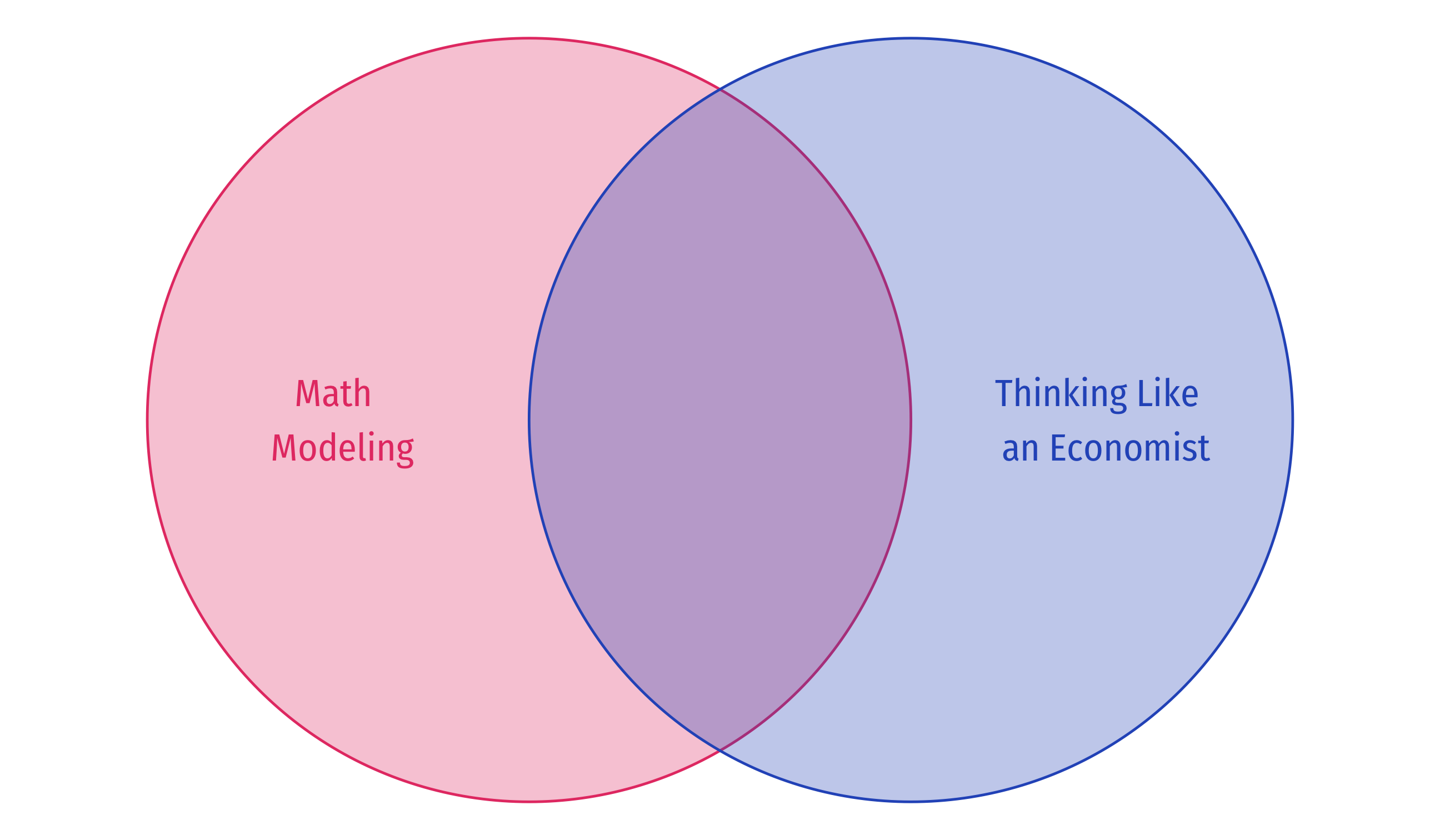

The Economic Point of View

Preferences are subjective

- Egalitarianism: Nobody's preferences are dismissed

Higher incomes + freedom of choice = greater preference satisfaction

Harder to directly evaluate outcomes, better to look at basic processes/mechanisms (especially exchange)

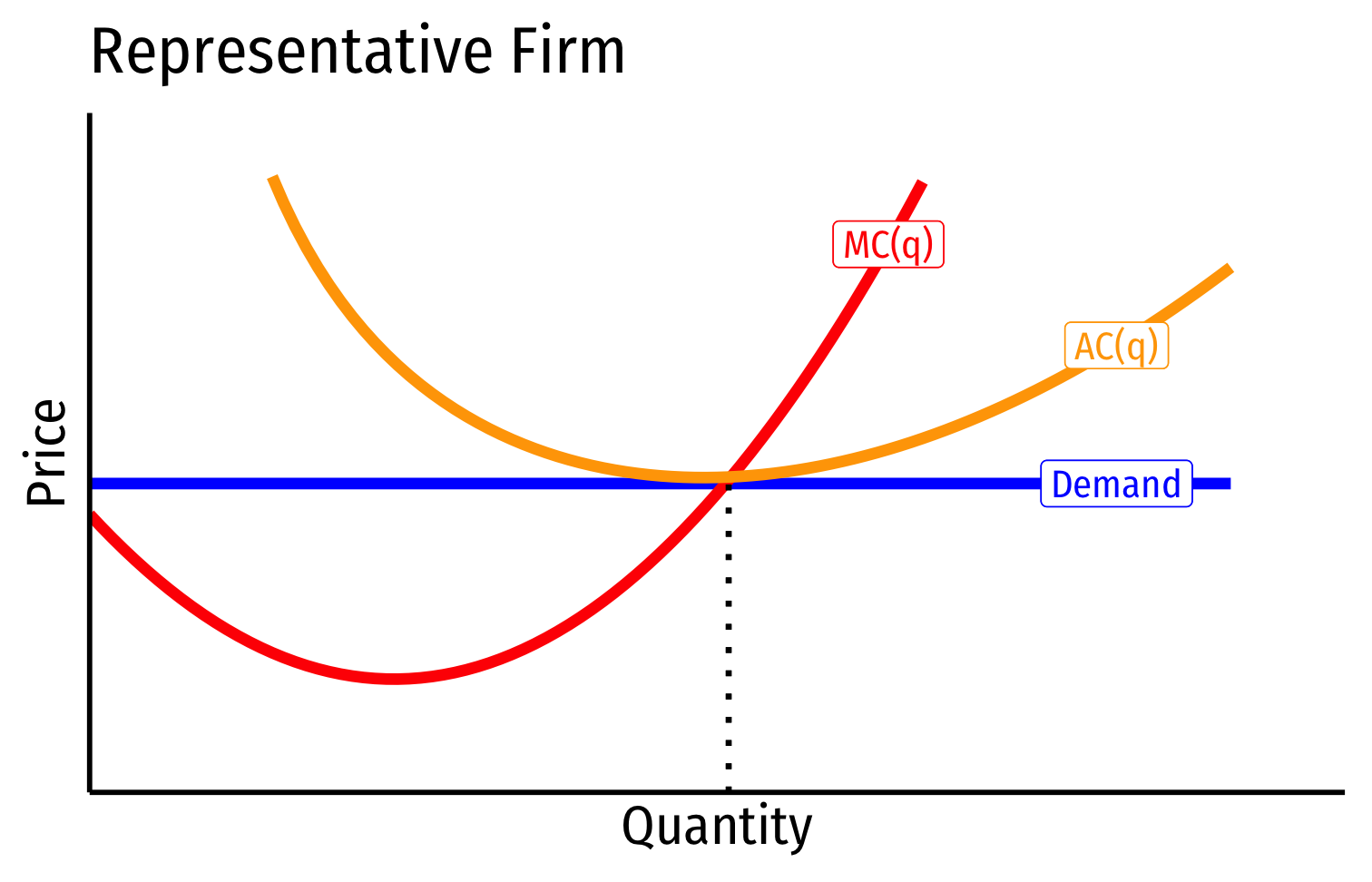

Perfectly Competitive Market

- In a competitive market in long run equilibrium:

- Economic profit is driven to $0; resources (factors of production) optimally allocated

- Allocatively efficient: p=MC(q), maximized CS + PS

- Productively efficient: p=AC(q)min (otherwise firms would enter/exit)

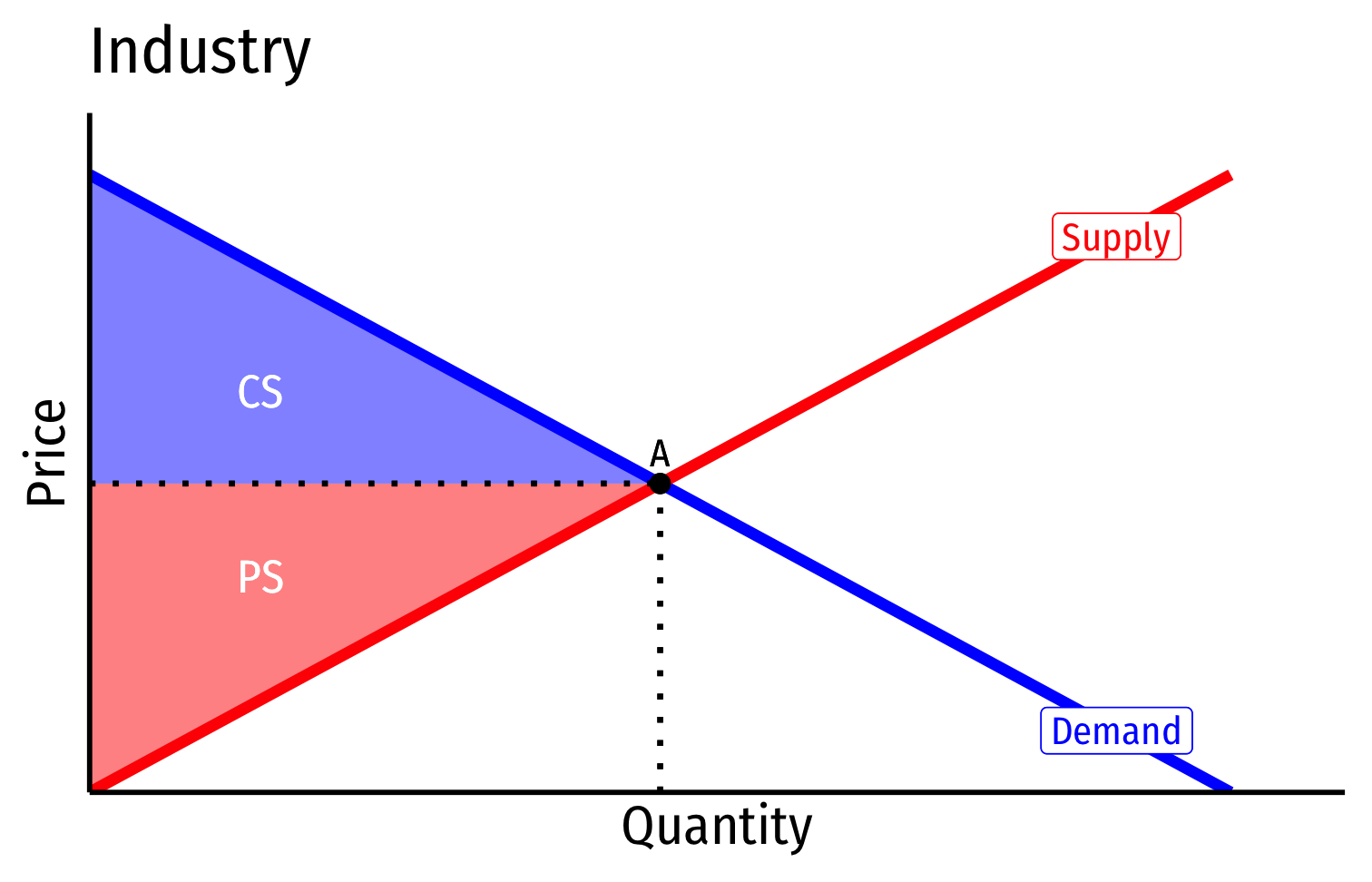

Allocative Efficiency in Competitive Equilibrium I

- Allocative efficiency: resources are allocated to highest-valued uses

- Goods are produced up to the point where marginal benefit = marginal costs

Allocative Efficiency in Competitive Equilibrium II

Economic surplus = Consumer surplus + Producer surplus

Maximized in competitive equilibrium

Resources flow away from those who value them the lowest (min WTA) to those that value them the highest (max WTP)

- creating PS and CS

The social value of resources is maximized by allocating them to their highest valued uses!

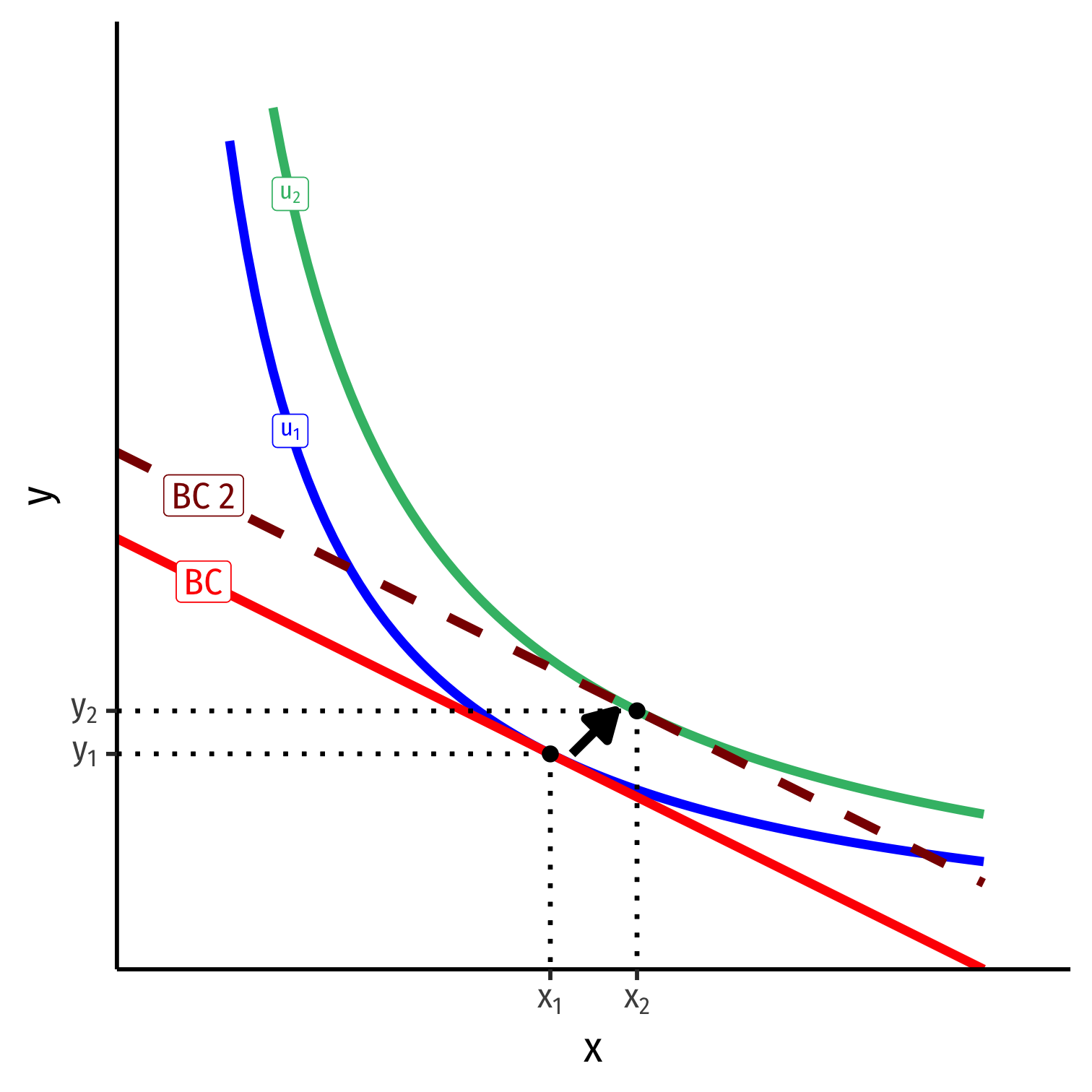

Markets and Pareto Efficiency

- Suppose we start from some initial allocation of resources

Markets and Pareto Efficiency

Suppose we start from some initial allocation of resources

Pareto Improvement: we make a change where at least one party is better off, and no party is worse off

Markets and Pareto Efficiency

Suppose we start from some initial allocation of resources

Pareto Improvement: we make a change where at least one party is better off, and no party is worse off

Pareto optimal/efficient: no possible further Pareto improvements

- (Might be many possible efficient allocations!)

†I’m simplifying...for full details, see class 1.8 appendix about applying consumer theory!

Markets and Pareto Efficiency

Voluntary exchange is a Pareto improvement

In equilibrium, markets are Pareto efficient: there are no more possible improvements

- all gains from trade exhausted, qS=qD, no pressure for change

Note Pareto efficiency contains a normative claim about equity:

- We may improve the total welfare of society,

- But if it harms even just 1 person, it’s not an improvement!

Markets and Pareto Efficiency

Pareto efficiency is conceptual gold standard: allow all welfare-improving exchanges so long as nobody gets harmed

In practice: Pareto efficiency is a first best solution

- only takes one holdout to disapprove to violate Pareto efficiency

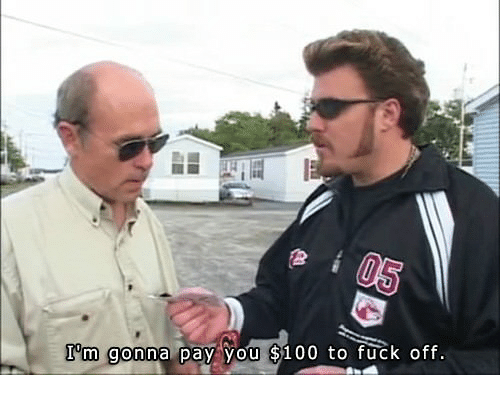

Markets and Kaldor-Hicks Efficiency

Kaldor-Hicks Improvement: an action improves efficiency its generates more social gains than losses

- those made better off could in principle compensate those made worse off

Kaldor-Hicks efficiency: no potential Kaldor-Hicks improvements exist `

Keeps intuitive appeal of Pareto but more practical

- Every Pareto improvement is a KH-improvement (but not the other way around!)

Consider policies where winners' maximum WTP > losers' minimum WTA

Policies should maximize social value of resources

Pareto vs. Kaldor-Hicks Efficiency

Example: “eminent domain”

The “takings clause” of the 5th Amendment to the U.S. Constitution:

“No person shall...be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

What is a “public use”? What is “just compensation”?

Kelo v. City of New London, 545 U.S. 469 (2005

Welfare Economics

- 1st Fundamental Welfare Theorem: markets in competitive equilibrium maximize (allocative, Pareto, KH, productive) efficiency

Welfare Economics

- Markets are great when:

- They are Competitive: many buyers and many sellers

- They reach equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

- There are no externalities: costs & benefits are fully internalized by the parties to transactions

Welfare Economics

Markets are great when:

- They are Competitive: many buyers and many sellers

- They reach equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

- There are no externalities†: costs & benefits are fully internalized by the parties to transactions

Market failure: if these conditions are not met

- May be role for governments, other institutions, or entrepreneurs to fix

† Or public goods, or asymmetric information. But I treat these as special cases of more common externalities.

Collective Action Problems

Generalizing: Collective Action Problems

Collective action problem: situation where an individual's interest and a group's interest may conflict

Benefits (or costs) of outcome flow to all members of the group

Decisions & costs need to be incurred by individuals

Individual preferences need to aggregate into a single decision/outcome

Collective Action Problem: Examples I

Collective Action Problem: Examples II

Collective Action Costs I

Groups may share a common interest

But composed of individuals with their own preferences

- Individuals bear the personal cost of contributing

- Individuals gain a small share of the benefits of group action

Additionally, transaction costs/ bargaining to get a group to agree on decision

Public Goods

A Classic Economic Problem

Public Good: a good that is non-rival and non-excludable

Rivalry: one use of a resource removes it from other uses

Excludability: ability or right to prevent others from using it (ownership)

The Free Rider Problem

Individual bears a private cost to contribute, but only gets a small fraction of the (dispersed) benefit of a good

If individuals can gain access to the good (nonexcludable) without paying, may lead to...

Free riding: individuals consume the good without paying for it

Examples?

Market Failure from Public Goods

No incentive for people to contribute and pay for the good

If enough people obtain the benefits without incurring the costs...

Not profitable for private market actors to supply it

Adam Smith on Public Goods

Adam Smith

1723-1790

“The third and last duty of the sovereign or commonwealth is that of erecting and maintaining those public institutions and those public works, which, though they may be in the highest degree advantageous to a great society, are, however, of such a nature that the profit could never repay the expence to any individual or small number of individuals, and which it therefore cannot be expected that any individual or small number of individuals should erect or maintain. The performance of this duty requires, too, very different degrees of expence in the different periods of society,” (Book VI, Ch. 9).

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

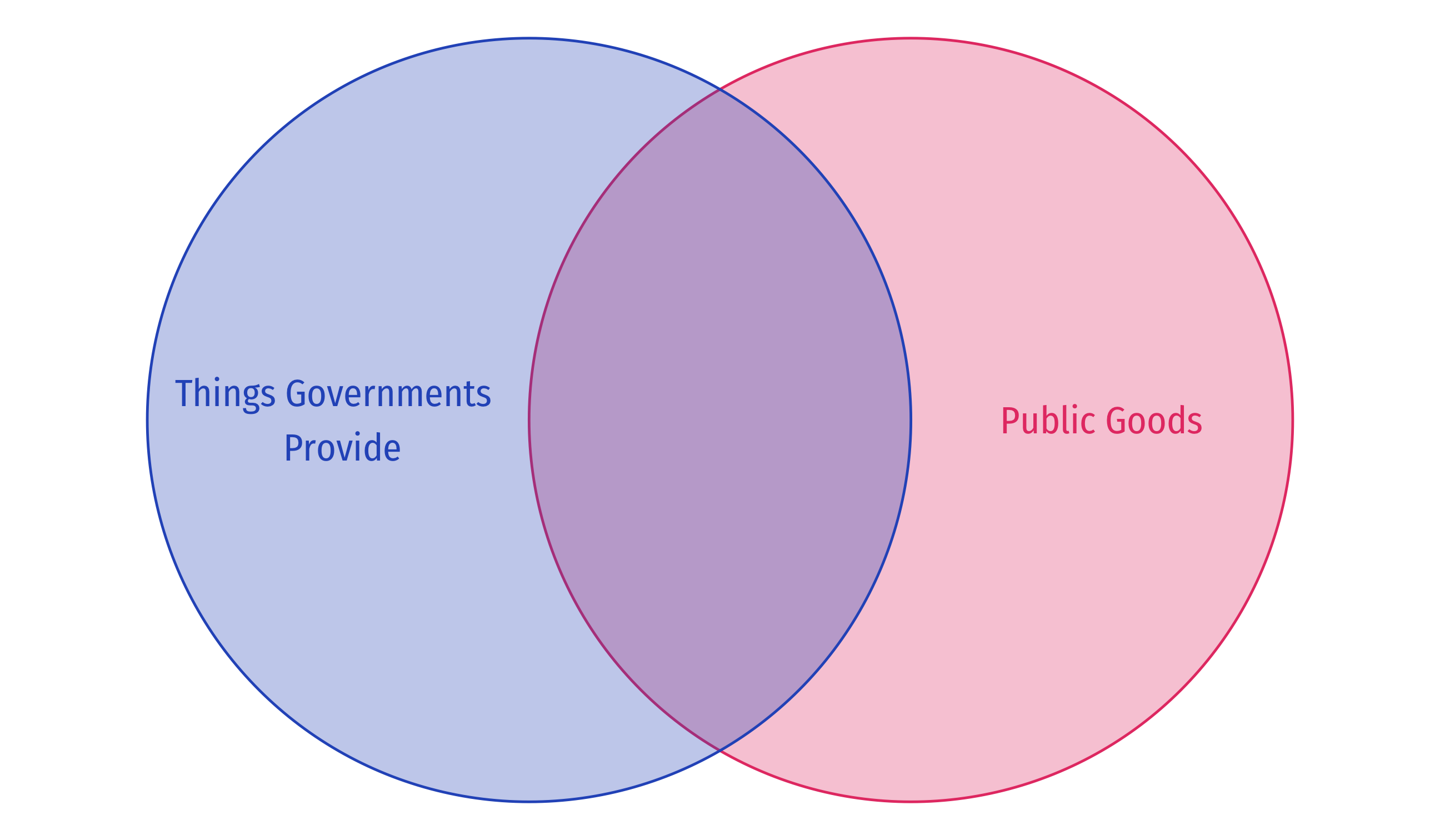

Public Goods ≠ “Good for the Public”

Safner, 2021, “‘Public Good’ or ‘Good for the Public?’ Political Entrepreneurship and the Public Funding of Scientific Research,” Journal of Private Enterprise 36(1): 17-44

Implications: Selective Incentives

Groups often need “selective incentives” to reward contribution and to punish free riding in groups

- Provide secondary private goods (insurance plans, access to trade publications, discounts, perks, etc.) to dues-paying members

Positive and negative incentives

Olson, Mancur, 1962, The Logic of Collective Action

Religions, Clubs, Cults, and Social Groups

Groups provide immaterial, “social/spiritual goods”, to individuals

- e.g. comfort, community, friendship, support system, therapy, good vibes

- Ex: religions, clubs, cults, fraternities/sororities, social groups, etc.

Good members must contribute to the group and not drain its resources

Groups often do some combination of the following to overcome the free rider problem:† Sacrifice and Stigma

Iannaconne, Lawrence, 1992, “Sacrifice and Stigma: Reducing Free-riding in Cults, Communes, and Other Collectives,” Journal of Political Economy 100(2): 271-291

Externalities: When the Price Isn’t Right

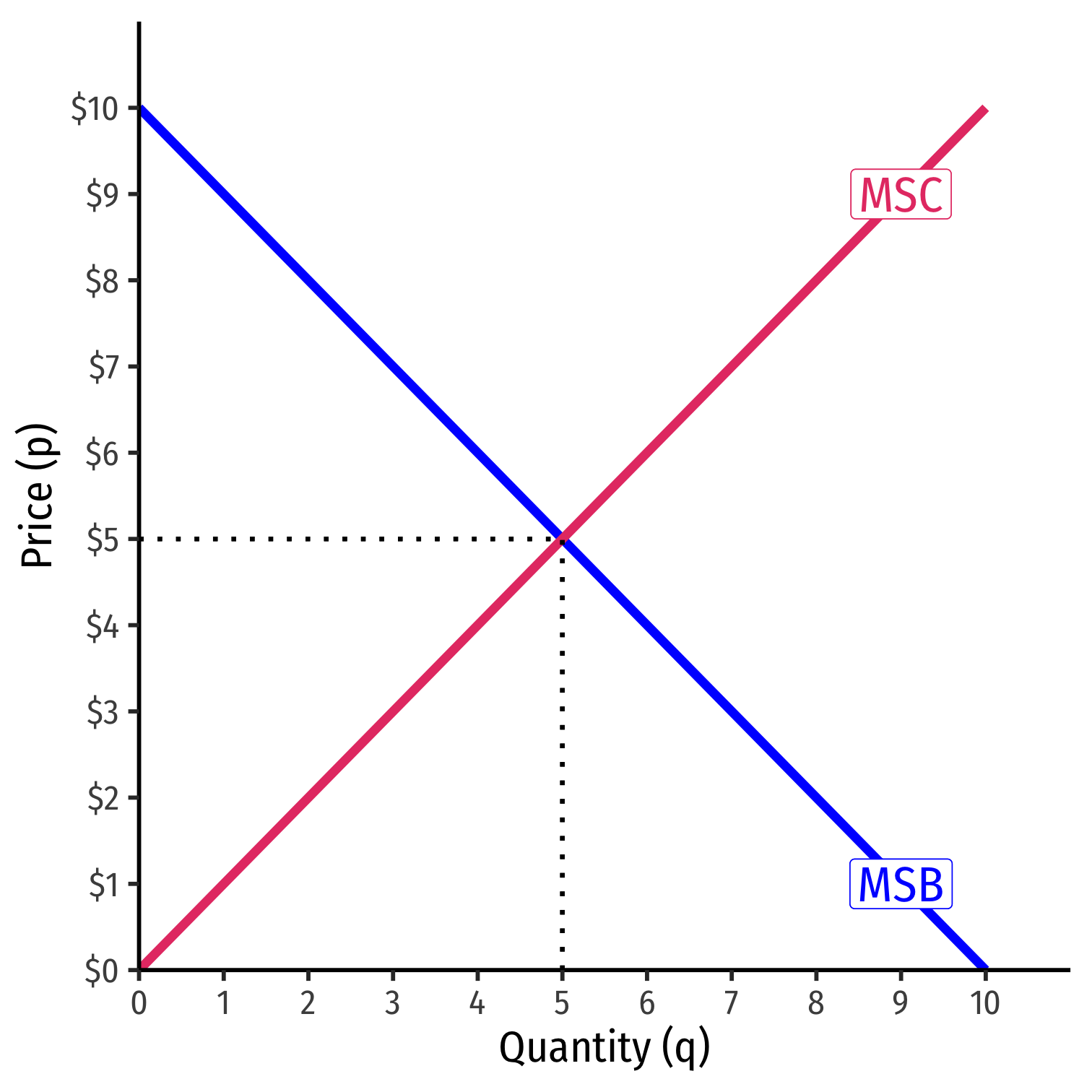

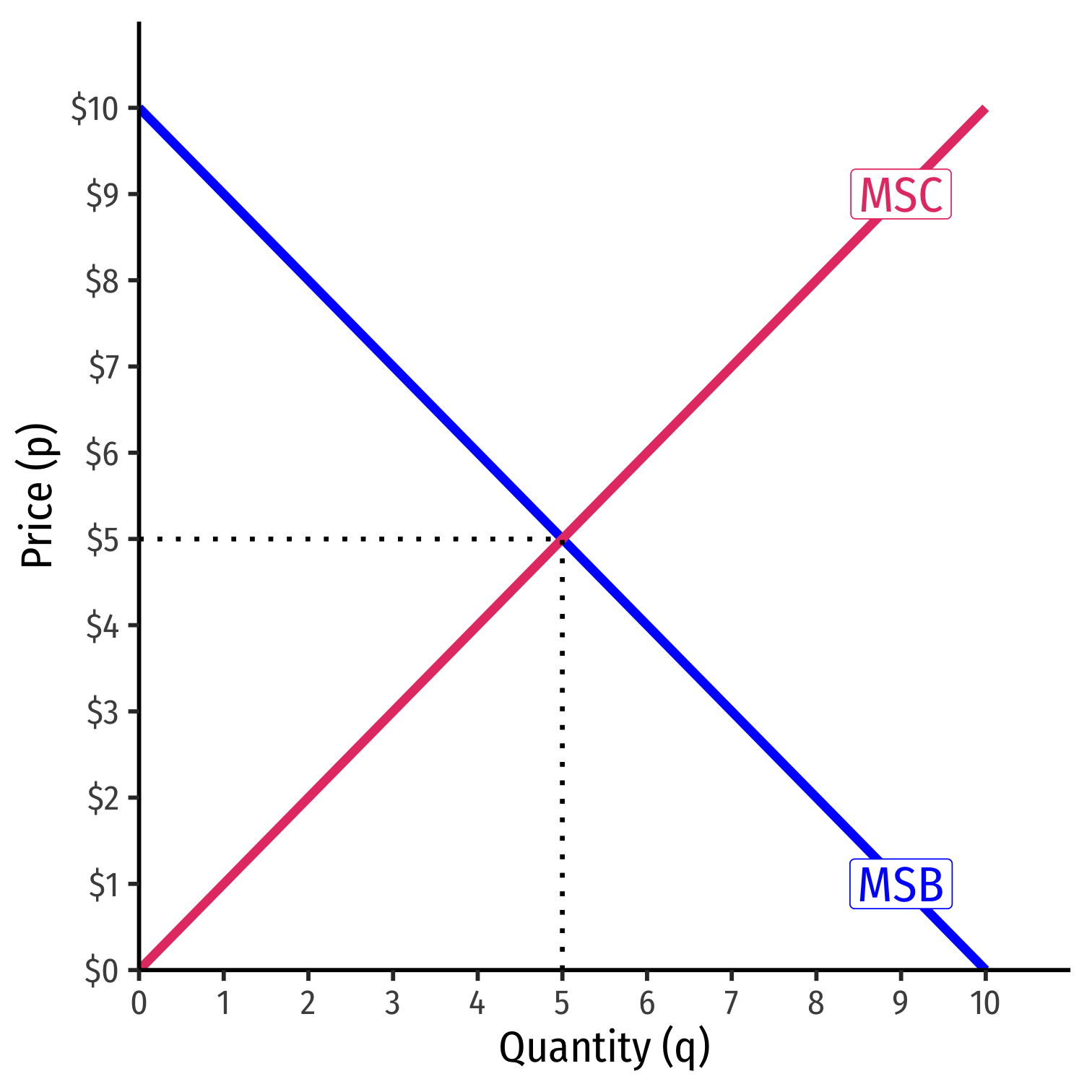

Supply and Demand: Social Costs & Benefits

Demand: marginal social benefit (MSB)

- value to consumers of consuming output

Supply: marginal social cost (MSC)

- opportunity cost of pulling resources out of other uses

Equilibrium: MSB=MSC

- using resources efficiently, no better alternative uses

Supply and Demand: Social Costs & Benefits

Price system mitigates costs and benefits of people's actions

People using scarce resources must account for consequences:

- Pay to pull scarce resources out of other uses in society

- Compensated for producing something valuable for others

Externality

Externality: an action that incurs a cost or a benefit not compensated via prices

Often interpreted as an action that affects (benefits or harms) a third party not privy to the action

Externality

The real problem is that it is external to the price system!

- A missing market!

People base decisions off of their preferences and opportunity costs of resources for society (captured in prices)

Prices properly negotiate the opportunity costs and provide information to people

But without price, decisions do not internalize those effects!

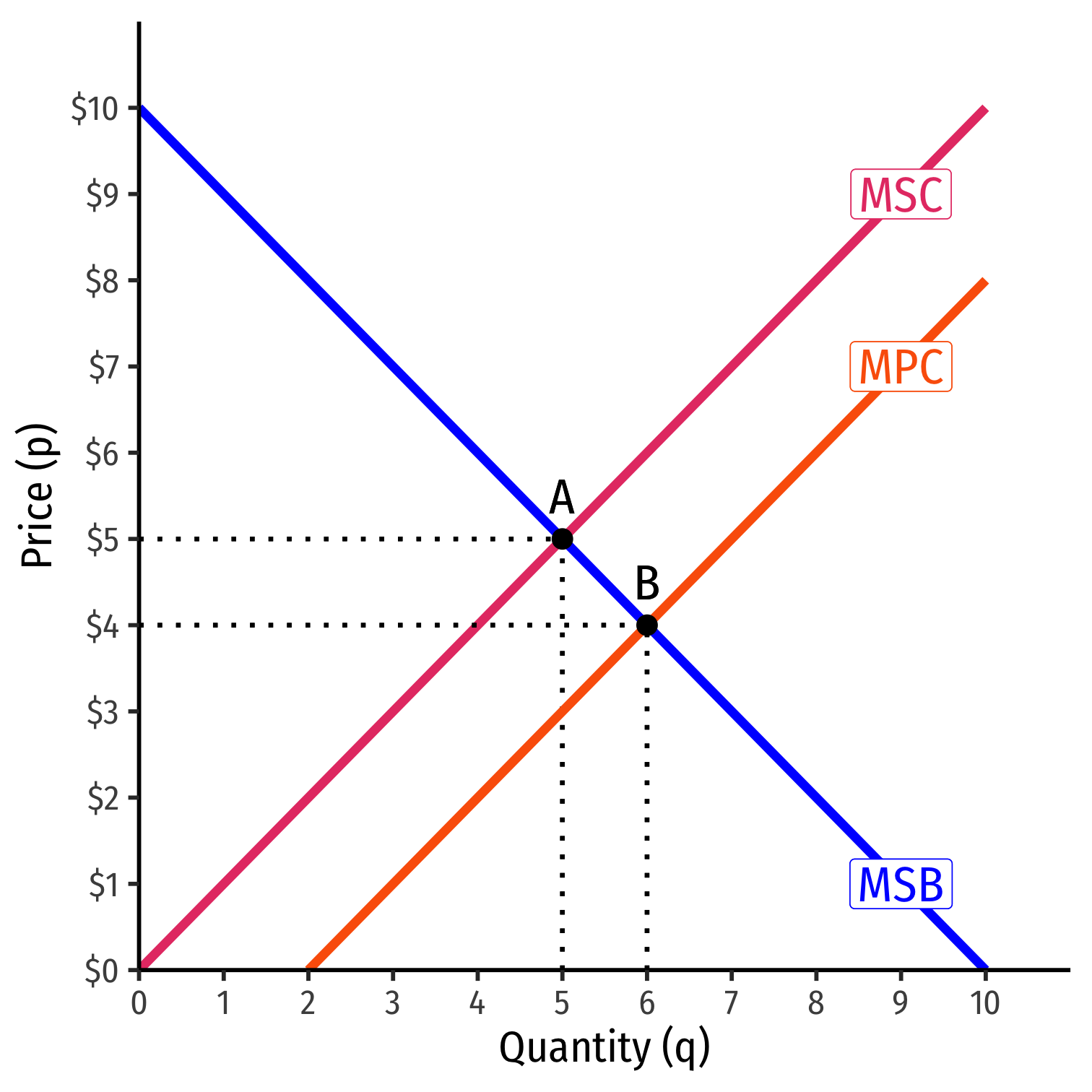

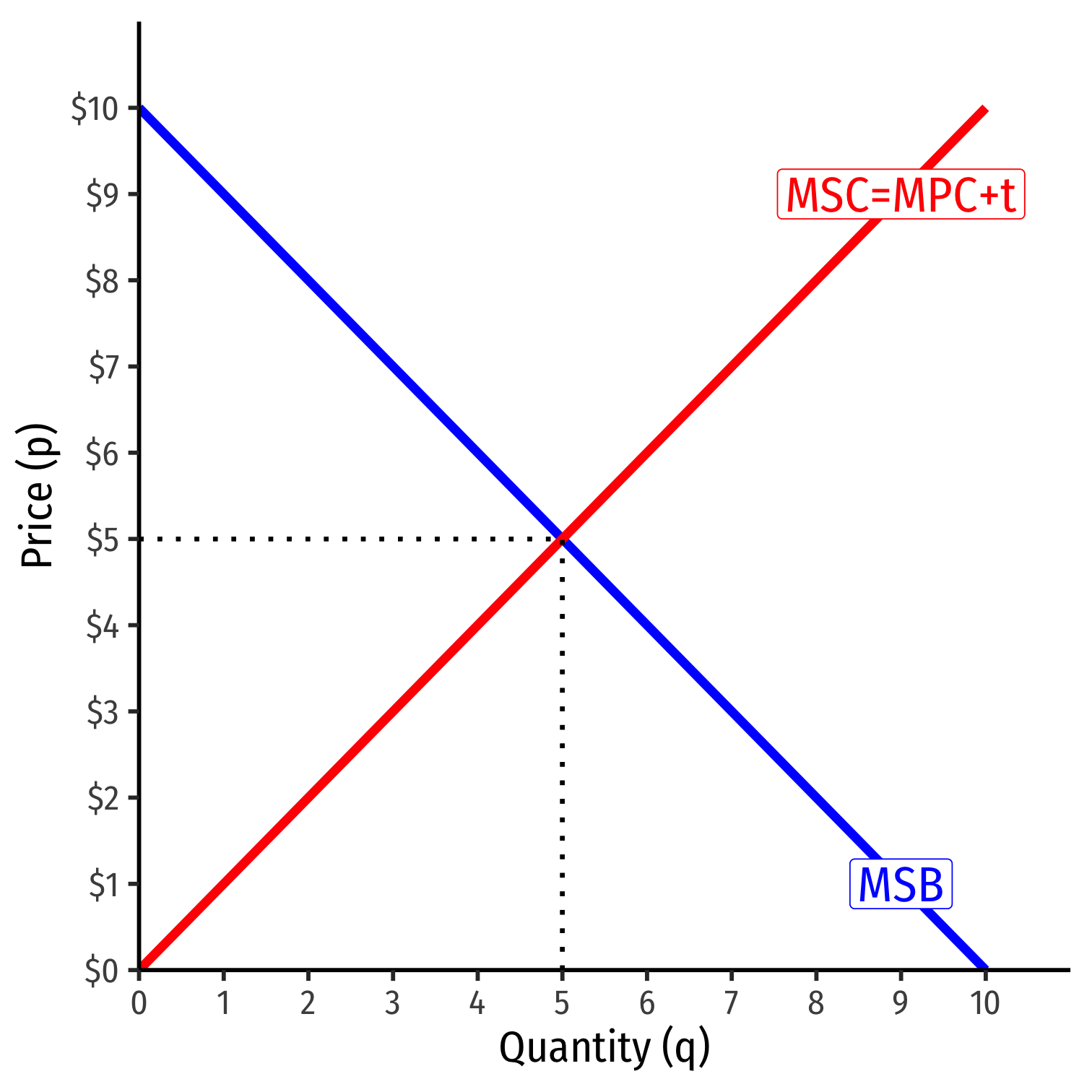

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much q at too low p compared to Social Optimum (A)

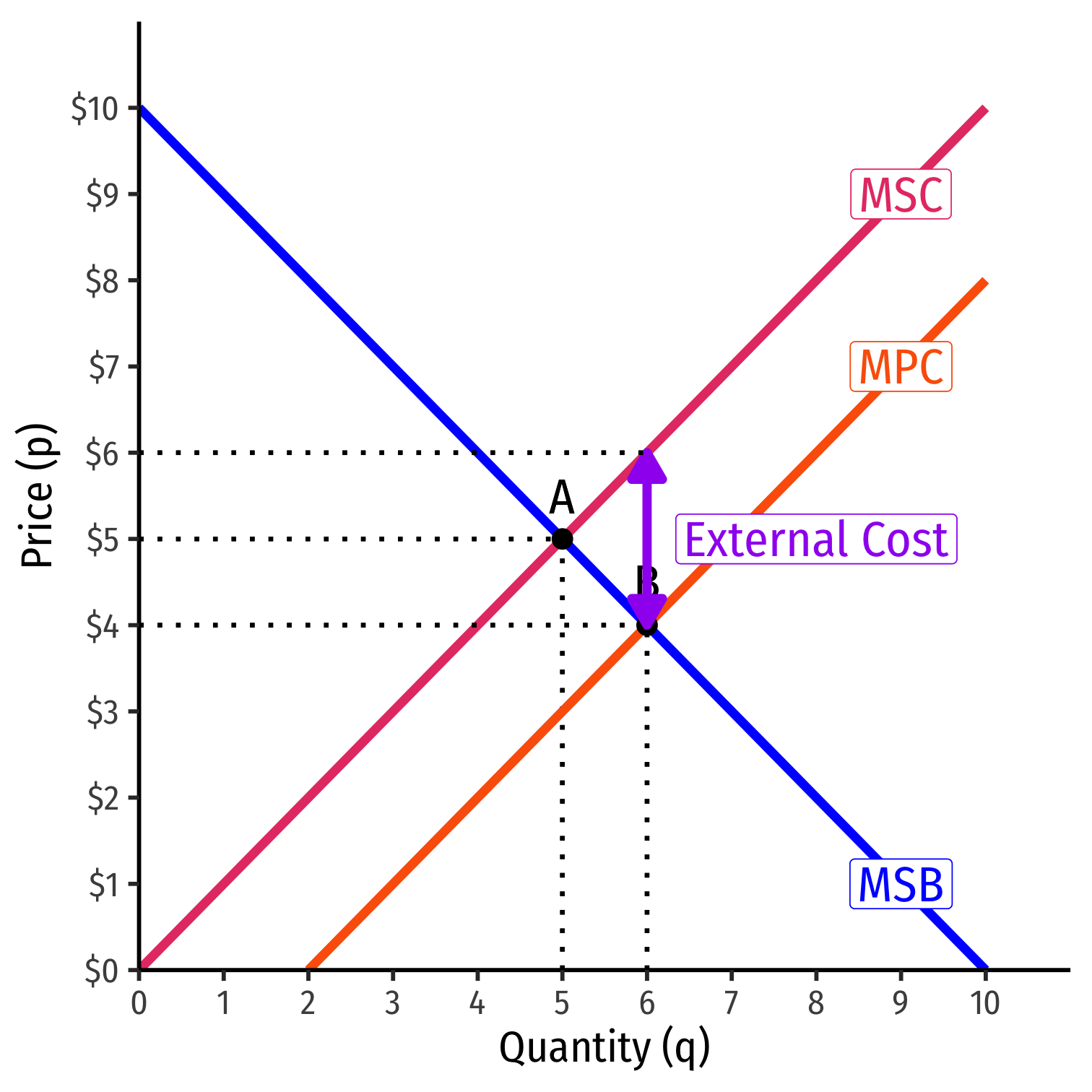

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much q at too low p compared to Social Optimum (A)

- Overproduction due to external cost

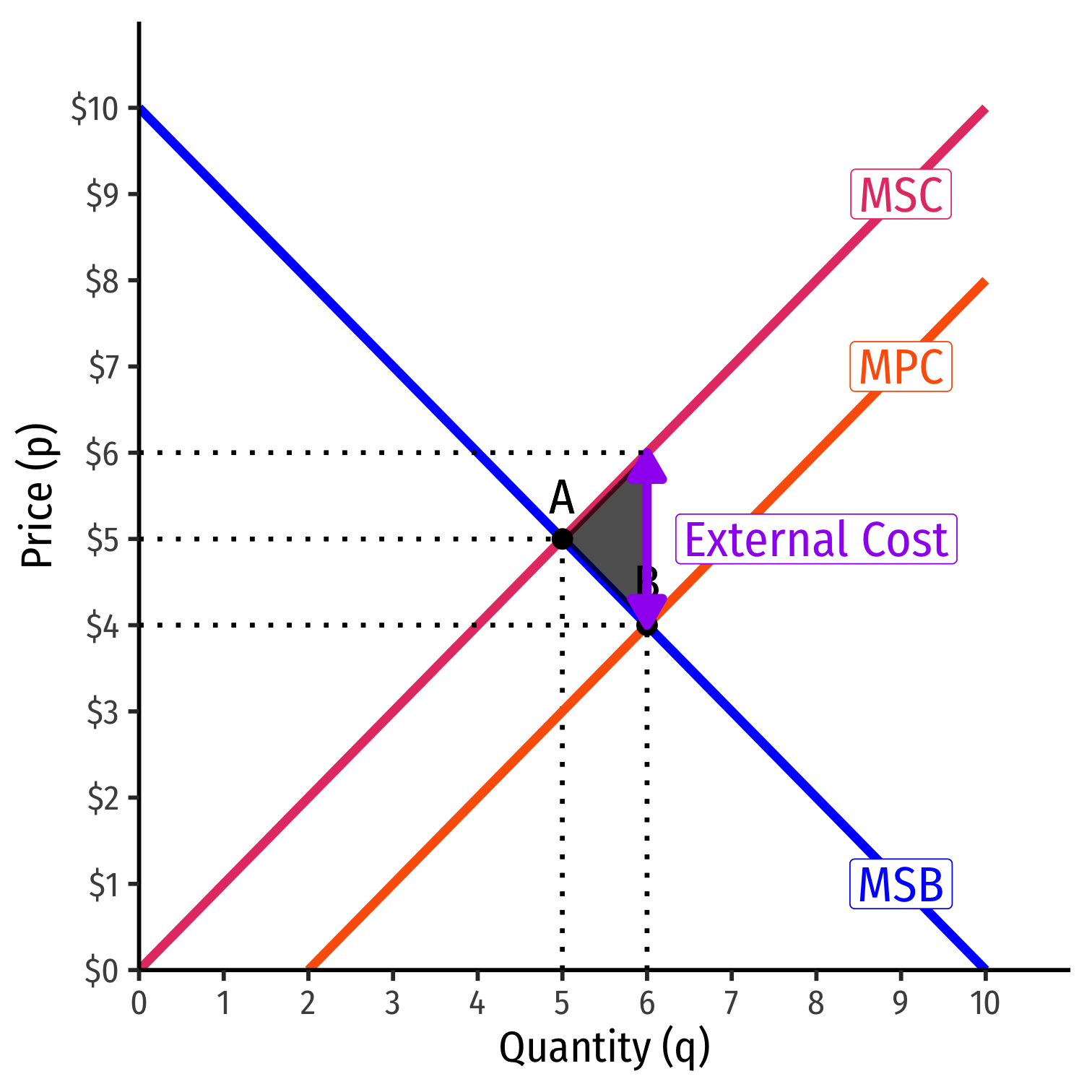

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much q at too low p compared to Social Optimum (A)

Overproduction due to external cost

A deadweight loss from overproduction

Negative Externality: Pigouvian Solution

A.C. Pigou

1877-1959

Policy solutions to externalities should focus on the missing price

- Narrowly tailor policy to create or modify price

“Pigouvian” tax or subsidy

Negative Externality: Pigouvian Solution

Set a specific tax t=MSC−MPC

Eliminates the DWL

Internalizes the externality into the price system

Producers (and consumers) now consider the true cost to society

- MPC (with tax) =MSC

Pigouvian Taxes

"Sitting is banned in the following places: "in St. Mark’s Square and in Piazzetta dei Leoncini, beneath the arcades and on the steps of the Procuratie Nuove, the Napoleonic Wing, the Sansovino Library, beneath the arcades of the Ducal Palace, in the impressive entranceway to St. Mark’s Square otherwise known as Piazzetta San Marco and its jetty." ($200)

Pigouvian Taxes

"I. A carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary. By correcting a well-known market failure, a carbon tax will send a powerful price signal that harnesses the invisible hand of the marketplace to steer economic actors towards a low-carbon future."

Signed by 27 Economics Nobel Laureates, 4 former Federal Reserve chairs, among many other famous economists

Pigouvian Taxes

"II. A carbon tax should increase every year until emissions reductions goals are met and be revenue neutral to avoid debates over the size of government. A consistently rising carbon price will encourage technological innovation and large-scale infrastructure development. It will also accelerate the diffusion of carbon-efficient goods and services."

Signed by 27 Economics Nobel Laureates, 4 former Federal Reserve chairs, among many other famous economists

Pigouvian Taxes

"III. A sufficiently robust and gradually rising carbon tax will replace the need for various carbon regulations that are less efficient. Substituting a price signal for cumbersome regulations will promote economic growth and provide the regulatory certainty companies need for long-term investment in clean-energy alternatives."

Signed by 27 Economics Nobel Laureates, 4 former Federal Reserve chairs, among many other famous economists

But It’s Not That Simple

How do we know what the right tax is? Will it be borne by the right parties?

Will it be administered correctly?

Are there opportunities for corruption?

Another Classic Economic Problem

Tragedy of the commons: multiple people have unrestricted access to the same rivalrous resource

Rivalry: one use of a resource removes it from other uses

Hardin, Garett, 1968, "The Tragedy of the Commons," Science 162(3859):1243-1248

Another Classic Economic Problem

Cannot exclude others

No responsibility over outcome

Incentive to overexploit and deplete resource (before others do)

A negative externality on others

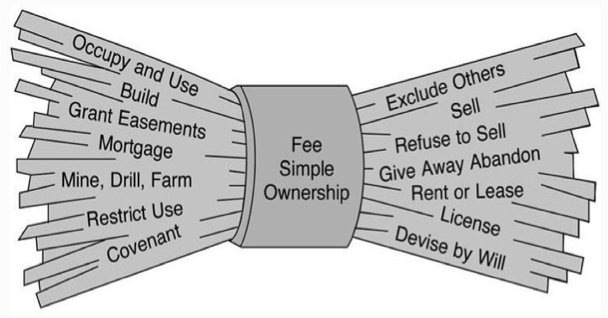

Importance of Property Rights

“Property is a bundle of legal rights over resources that the owner is free to exercise and whose exercise is protected from interference by others” (Cooter and Ulen, p.73)

- This bundle contains a lot of rights, to:

possess, use, develop, improve, transform, consume, deplete, destroy, sell, donate, bequeath, transfer, mortgage, lease, loan, or exclude others

Coooter, Robert and Douglas Ulen, 2012, Law and Economics, 6th ed.

How Should Property Rights Be Allocated? Easy Case

Example: There is a car which you value at $3,000, and I value at $4,000.

- It is efficient for me to end up with the car.

How Should Property Rights Be Allocated? Easy Case

Example: There is a car which you value at $3,000, and I value at $4,000.

It is efficient for me to end up with the car.

Suppose I start out with the car

How Should Property Rights Be Allocated? Easy Case

Example: There is a car which you value at $3,000, and I value at $4,000.

It is efficient for me to end up with the car.

Suppose I start out with the car

Suppose instead, you own the car

How Should Property Rights Be Allocated? Easy Case

Example: There is a car which you value at $3,000, and I value at $4,000.

It is efficient for me to end up with the car.

Suppose I start out with the car

Suppose instead, you own the car

It does not matter who is initially assigned a property right, our bargaining will reach the efficient result!

It (Often) Doesn't Matter How We Start

- This is the essence of what is called the Coase theorem:

If transaction costs are low, with well-defined and tradeable property rights, parties can bargain voluntarily to reach the efficient outcome.

- Note: the starting point does matter for distribution!

Coase, Ronald H, 1960, “The Problem of Social Cost,” Journal of Law and Economics 3: 1-44

More Interesting: Incompatible Uses

We don't need to resort to law for mutually-agreeable transactions (like the car)

What's more interesting are incompatible uses of our own property that give rise to conflict

- One person's use of their own property imposes an externality on another

Here, we do need the law to define the rights...but that's not the end of the story

Some Examples of Property Disputes

My neighbor likes tall trees

- does she have the right to plant a tree on her property that shades my pool?

- do I have a right to an unobstructed view? or an unshaded pool?

You want to have a party

- do you have the right to make noise in your house/dorm?

- does your neighbor have the right to good nights sleep in their house/dorm?

I own a small plant located on a river

- do I have a right to use the river for cooling?

- do I have a right to pollute as much as I want?

Externalities Adjudicated at Law

Most externalities in U.S. mediated through common law

Courts assess how much harm was caused

Individuals causing harm to others must pay:

- compensatory damages (to redress harms)

- punitive damages (to deter future externalities)

Externalities persist if property rights are not clear or are not enforced

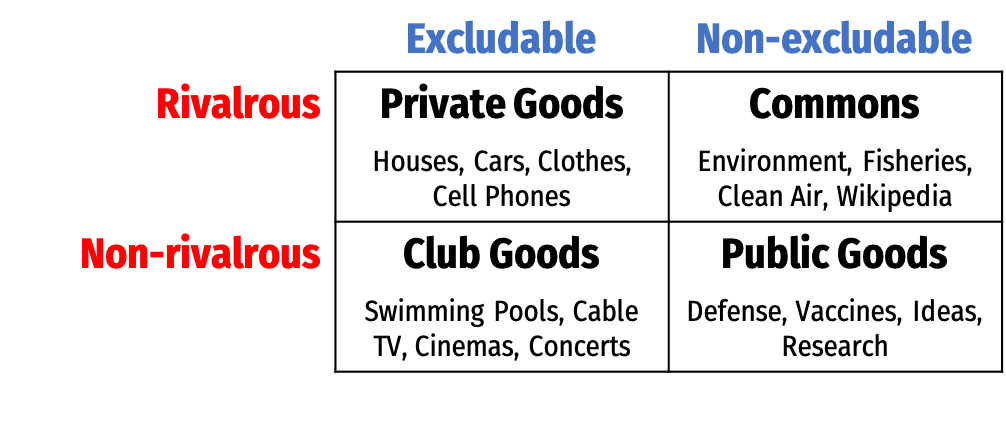

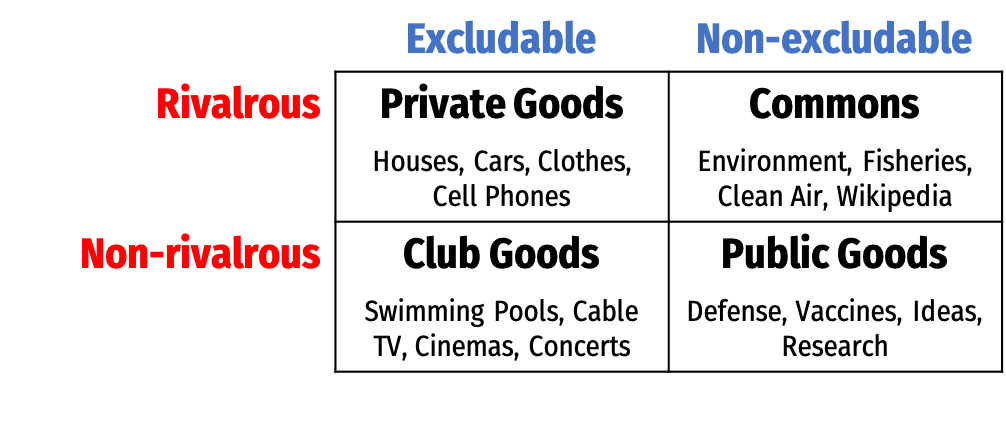

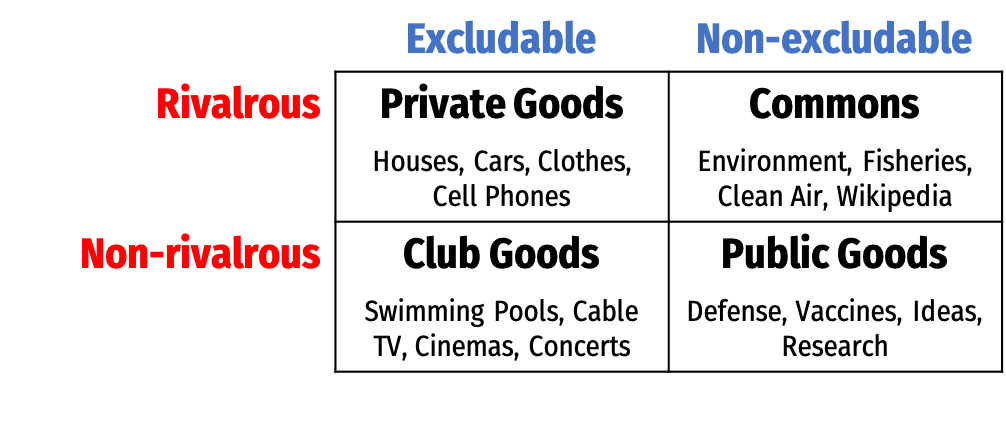

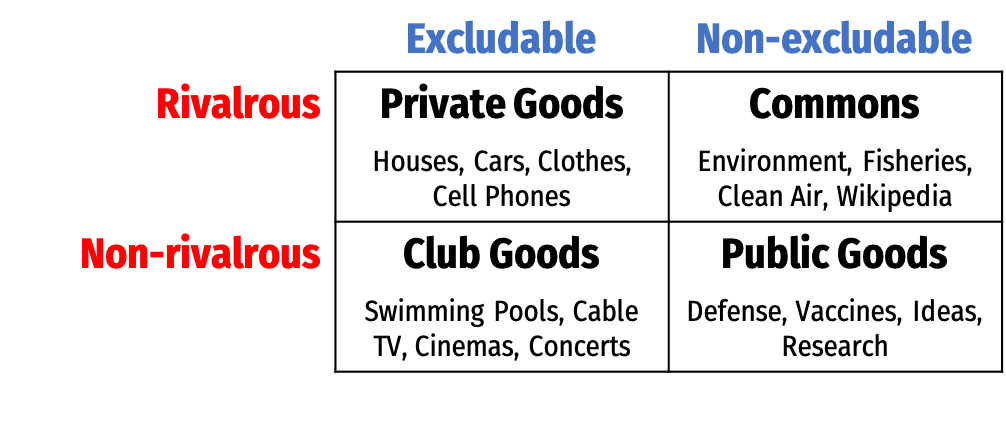

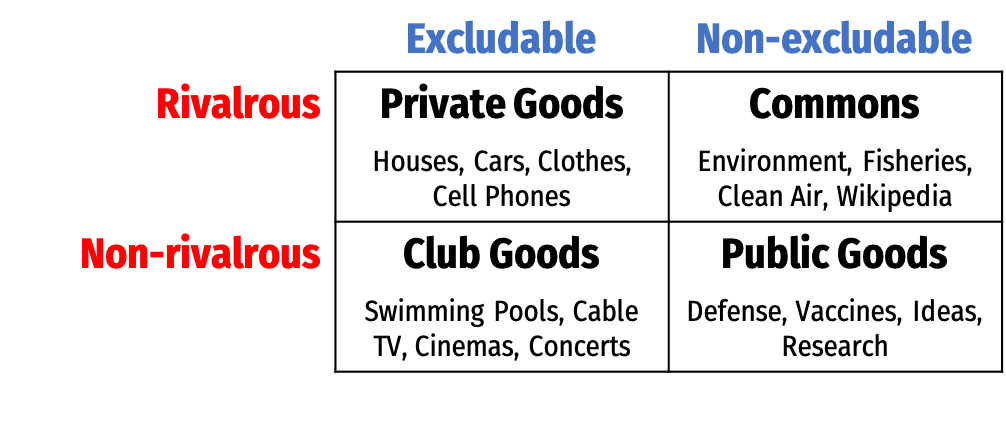

Summarizing Types of Goods

- Can classify into 4 types of goods based on rivalry & excludability

Summarizing Types of Goods

Can classify into 4 types of goods based on rivalry & excludability

Economics mostly focuses on “private goods”

Summarizing Types of Goods

Can classify into 4 types of goods based on rivalry & excludability

Economics mostly focuses on “private goods”

Largest issues with “public goods”

Summarizing Types of Goods

Can classify into 4 types of goods based on rivalry & excludability

Economics mostly focuses on “private goods”

Largest issues with “public goods”

Can transform public goods into “club goods” by making them excludable

- Managed by an organization, transformed by technology

- Think about selective incentives

Club Goods

Summarizing Types of Goods

Can classify into 4 types of goods based on rivalry & excludability

Economics mostly focuses on “private goods”

Largest issues with “public goods”

Can transform public goods into “club goods” by making them excludable

- Managed by an organization, transformed by technology

- Think about selective incentives

“Common resources” can be managed with the right set of rules or property rights (otherwise the tragedy of the commons results)

Common Resources

Elinor Ostrom

1933—2012

Economics Nobel 2009

A wide variety of solutions are possible for managing common resources efficiently

- Government management

- Purely private property

- Civil society organizations

So long as they set up good rules that solve the free rider problem, remove the incentive to overuse resource, negative externality on others

An Example, Using Social Norms

An Example: Wikipedia

Safner, Ryan, 2016, “Institutional Entrepreneurship, Wikipedia, and the Opportunity of the Commons,” Journal of Institutional Economics 12(4): 743-771